I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

If you ever wanted proof that a population that doesn’t understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you’d more likely support higher tax rates for the rich.

I think this is at least partially the result of intentional propaganda. It benefits the elite greatly if a lot of Americans are screaming against higher top tax rates due to this faulty logic. There are also a lot of anecdotes of people not accepting higher paying job offers or promotions within their company, which also benefits the business owners.

https://youtube.com/shorts/-621rVJvUdY

Mr. “Population collapse is the biggest threat to the world.”

Maybe it’s just the biggest threat to capitalism and your ROI. Why do you think he’s supporting the make everyone dumber party?

If you ever wanted proof […] here it is.

Yes! Well yes but also no but only because…

@General_Effort@lemmy.world I always do the web search when OP didn’t happen to think about linking a source but this is egregiousDANGIT IT’S A SHITPOST I AM SO SORRY

To be clear for those unaware, you pay the lower bracket rates for the amounts earned in that bracket and the higher bracket rates for the amounts earned above that bracket.

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

try telling this to people who think government agencies pay taxes

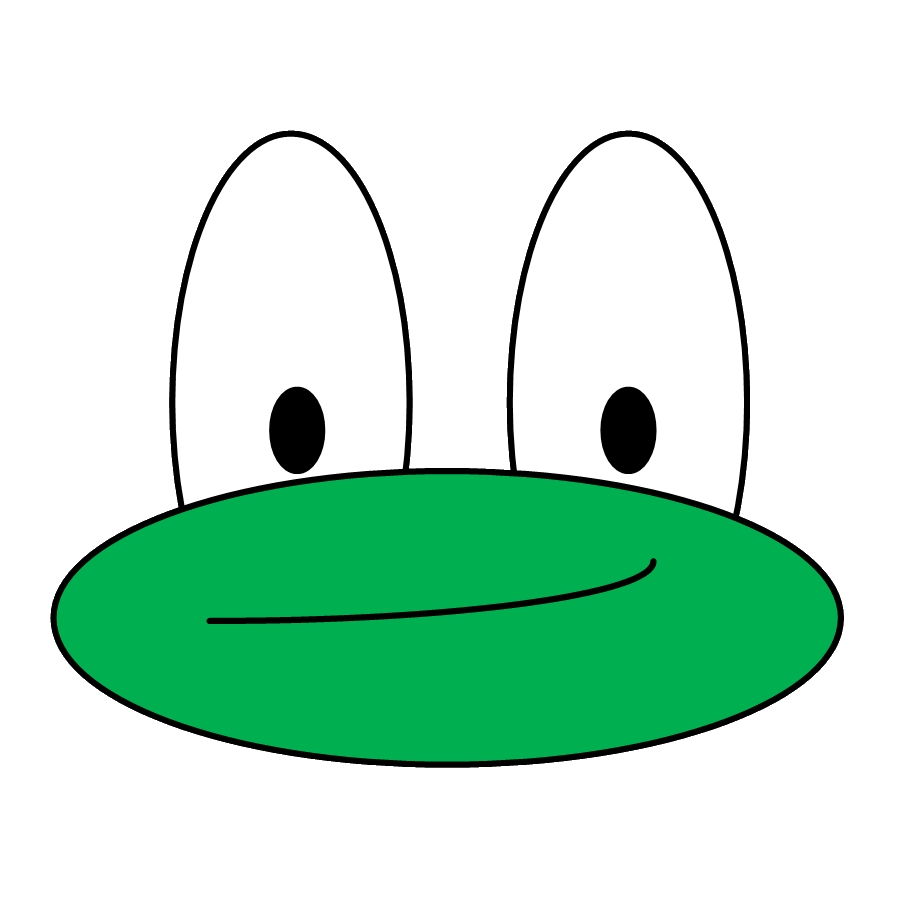

Sam is the GOAT

That dude would have been hilarious if he wasn’t really so delusional. Not Sam, he was great. The dude that was convinced that government agencies get tax breaks.

What? Is this the onion?

One of those rage bait YouTube channels had a young person who made that claim in a debate. Pictured is Sam Seder who was the debate opponent. He made this face at the camera.

The channel is Jubilee. The format is that 1 fairly prominent political activist debates 20 people with an opposing position for a few claims the 1 has given beforehand. The 20 swap out who gets to debate at any particular time by voting them out.

I’ll admit it is ragebaity sometimes, but I also find it educational and entertaining. There’s typically about two among the 20 that have gone off the deep end, but everyone else is respectful and appreciative of the opportunity to engage the other side. Also, it does have good fact-checking so the crazies are at least recognized properly.

This is the video the image came from.

They give Nazis a platform. I don’t watch it because of that. Plus I try to avoid rage bait content as much as I can.

That was an entertaining 90 minutes of YouTube! And I definitely saw that face

Thanks

And they’ll also refuse to believe you when you try to explain it to them

Hungary used to have a system, which worked like what the republicans imagined, which made “taxing the rich more” a widely unpopular move…

FWIW globally, there is the issue of “welfare traps”. Benefits for low income people are usually tied to income (or savings). Once income reaches a threshold, these benefits must be replaced with income. So a higher income may result in a net loss.

How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

And this why democracy won’t work. How can people votw in their best interests when they don’t know how basic taxes work

These people are allowed to vote, and that is why we are all fucked.

this was pushed in the 80’s/90’s on conservative talk radio (iirc). strangely, it gets an ideological push from the phenomenon of income reduction resulting from lost welfare benefits as income increases. the brain correlates things irrationally.

When you are talking large income to larger income, that makes total sense, but are there limits for access to things like child tax credits where if you go over you are no longer eligible, causing significant increase (I just looked, and it’s at $200k single of $400k jointly, so unless you have A LOT of children, I suppose there wouldn’t be a huge effect)? Similar to people on government assistance who go from getting full assistance to getting nothing at a certain income level?

This is a big factor. A lot of people conflate less benefits with higher taxes because fear-brain just knows they both equal increased hardship in the end. They’re technically wrong but their statistically slightly more active amygdalas are responding to a genuine threat, just one that they’ve been very skillfully misdirected into helping worsen.

The big one there is food and housing subsidies. The way way we have it set-up can create a situation where a raise can cost you benefits that are worth more than the raise. With disability benefits there can actually be limits on the amount of money you’re allowed to have in general, which means that disabled people can find themselves in places where not only do they need to avoid trying to find work that they might be able to do, since trying and failing can still make them need to restart the benefits application process or even pay back historical benefits, but they also need to reject gifts above a certain value and can’t prepare for any type of emergency, like a car breakdown.

It’s annoying because it creates a disincentive to do the things that would help people on assistance actually get off of it, when the people who push for those limits purport to want them for exactly that reason.

Tapering off benefits as income grows, but at a slower rate than the income growth creates a continuous incentive for a person on benefits to increase their earned income. (If you lose $500 in benefits for every $1000 in income, your $1000 raise still puts $500 extra in your pocket, instead of potentially costing you your entire $8000 food subsidy)Can’t do that though, because it doesn’t punish people for the audacity of needing help.

For someone outside the American tax system, can anyone put the difference in approximate numbers?

This all boils down to a common misconception about ‘tax brackets’.

To simplify, pretend there’s a 28% tax bracket up to 100,000 dollars, and a 33% tax bracket when you hit 100k. The first 100k is always taxed at 28%, no matter what you make, and it’s only the incremental amount that gets taxed heavier. So here in this example, that would mean tax burden would be 28,000.33 instead of 28,000.28. These are not the exact brackets or percentages, but it’s at least showing the right magnitude of increase versus total amount.

However, many people are “afraid” of bumping a higher tax bracket. They think the tax bill would go from 28,000.28 to 33,000.33. That the tax bracket bumps up all your liability. I remember growing up people saying “I have to watch out and not hit the bigger tax bracket, if I’m close then I need a big raise to make it worth it, or else the raise is going to cost me more than it would make me”. This a big driver of antipathy toward democrat tax policies, a belief that mild success will punish them, despite it only increasing on the incremental amount.

To be more specific the first 100,000 isn’t taxed at 28%. The 44 to 100k range would be, but below that will be taxed at lower percentages. The first ~10k you make is taxed at 10%, and then it increases throughout.

If getting specific, there’s no 28 percent or 33 percent bracket, so these are all examples rather than real figures. I did make a comment using real numbers, same general magnitude but just more specific about the brackets.

OK, so it is similar to our system. And would probably in the range of cents or a few dollars then.

German income tax works the same and most Germans get it wrong too. It’s really infuriating.

In exact numbers, 5 cents.

Your local tax system probably works the same.

Hmmm, I better send a suggestion letter to the ATO (Australian Taxation Office) to put the tax bracket breakdown directly into your return with the amounts populated.

Hey, they give us a breakdown graph of where our tax is going, this seems like it’s within the realm of possibility.

I think sadly there are also many people here who have no idea how tax brackets work…

Thanks, Lemmy, now I’m “that Dad”. After reading this, I went to dinner with my two teens and one of their girlfriends, so of course I had to bring this up. All three have started working after school and will need to file their taxes this year so they need to know.

But holy crap is that a seriously uncool conversation

Tell me you don’t know how income taxes work without telling me you don’t know how income taxes work.

My question is who does their taxes then?

No source?