Most workers who aren’t saving for retirement through their employers aren’t saving at all, the study found

New data suggests the average American worker has under $1,000 saved for retirement.

A report from the National Institute on Retirement Security found that the median savings for all employed adults between the ages of 21 and 64 were approximately $955. The study includes workers with 401(k) and other retirement savings plans, as well as the approximately 56 million workers who do not have access to employer-sponsored retirement plans.

Workers with retirement savings plans have a median balance of approximately $40,000 saved, according to the report. That figure is nowhere near the $1.5 million that Americans say they need to feel comfortable fully retiring.

Fucking high rollers over there

My retirement plan is to die at work, that way my family is taken care of. (who am I kidding, my work will try to weasel out of paying them if that happens)

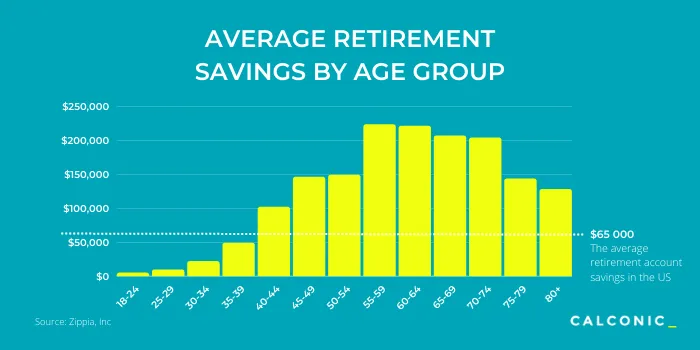

This is a terrible stat. Taking the people who are entering the workforce and averaging them with people who have spent a lifetime working. Not only that, but that’s just “retirement” savings. How many 20 year olds have retirement accounts?

The information would be far more realistic if it were grouped by decade of life.

Edit: Here. This is a little better

Savings

Retirement savings

Median, not average, so much better at showing this situation than mean but it’s still not great. I agree that it should be broken up, but the difficulty is how you define the grouping will have a significant impact on the results, especially in early and later years.

I’d prefer median by age graphed by age. Average by any grouping will skew heavily if there is a lot of variance, and I absolutely expect there is in the US. A box-and-whisker plot could also be ideal here, but you still have the grouping problem.

Garbage.

Tell me the average of all people who have more than zero (and the number that represents), then tell me how many have zero.

This number 955 doesn’t mean shit.

Our lavish lifestyles include paying for food, shelter, healthcare, power and water and it keeps costing more and more but there’s record shareholder profits!!! Yeah! You should be happy that the economy is great for pedofiles who rape children and possibly(checks notes) eat babies on yachts. Cool! they’re openly using all our tax dollars with the goal of making us working people obsolete while mass surveilling us and killing dissenters in the streets. Awesome

If your employer offers a 401(k) match, not trying to take advantage of that is one of the absolute dumbest financial moves you can make. Yes, I understand people sometimes can’t that’s why I said “try”.

Another move is not investing early. The biggest boost to wealth in retirement is start saving early to take advantage of compounding interest.

I’ll upvote for the “try”. Most people I know in tight spots need the money NOW. They are barely thinking 1 year ahead let alone 40.

I know people like that too. Those same people don’t know how much they spend on anything, don’t know where their money is going, and waste money on entertainment (subscriptions), drugs/alcohol, it other stupid shit. I wish they were more aware of their personal finance because I’d hate to see them when they’re 55 trying to figure it out at the last minute.

They have never wanted us to retire. They want us to work until we die.

workers will not be allowed to work until they die unless its a really menial job. Every normal mundane mistake you make as an older worker, your bosses look at you trying to decide if you are too old to do the job.

Very misleading stats. What’s the breakdown by age group? A 21-year old with <$1000 in savings is very different from a 64-year old. Talking about the “average worker” across that wide of an age range is totally meaningless. What’s the median age?

Soon there will be a critical mass of people who have nothing left to lose. Thats why the Democrats and Republicans need the military in the streets. Their wealthy benefactors cannot allow anything like the New Deal to happen again.

And you guys don’t have a state pension either, right?

You guys really need to get on with a revolution. Work until you die is kinda supposed to be something we are moving away from

Life expectancy keeps lowering so no need to worry about retirement.

oh thank god. Freedom from this awful system.

There’s social security, which does give seniors enough to exist, but not much else.

I’m sure the situation is dire, but I’m not sure it communicates an accurate picture by lumping in 21 year olds with people who’ve been in the workforce for decades.

21 yr olds who are just entering the workforce or are in college aren’t expected to have much, if any, retirement savings at that stage in their lives.

A better picture would be to break it down by age group. Still not a pretty picture, I’m sure.

Wouldn’t surprise me at all if the average retirement savings of those in their 50s is like $100,000

I’m slightly heartened to see the average is higher than I thought

I didn’t start having meaningful savings until my mid 20s. When i bought a house paying off the mortgage became a priority over saving for retirement. I’ll be better off paying less interest and reducing my expenses faster than I would be collecting interest on that money. In theory i could out perform my mortgage interest rate by trading stocks, but that is a lot riskier than paying off the mortgage.

Trading stocks is probably the worst investment strategy any normal person with a market-unrelated job and life responsibilities could pursue, with almost guaranteed losses in the long term. Good on you for identifying the high risk early in life- never forget it. That being said, there’s very strong arguments for investing in stocks, but do it the boring way: large blended ETFs with a low expense ratio (like VTI, VTV, VOO, VXUS, or the Boglehead favorite: VT) or mutual funds. Don’t “trade,” buy and hold and try to forget you even have a brokerage account housing those blended, diversified funds. Try to use tax-advantaged vehicles as much as possible, like a Roth IRA or a Roth option in a 401k. Your mortgage APR is what? 4-7%? The market should definitely outperform that in the long term, and you can reduce your exposure to acute transient shifts even more by dollar cost averaging into your savings. I’m all for paying off debt as quickly as possible, for the psychological benefit, but there’s also the rate race of your investment’s probable APY vs your debt’s APR.

I’ve been diversifying into some long term stock options in some of my savings accounts. I live quite frugally so I am able to still save a bit while paying a bit extra to my mortgage. So far I’ve done pretty good in the markets but my trading accounts aren’t significant sums of money, when they do well I sometimes wish I invested more but when a stock is down bad I’m reminded why I keep those sums low.

People underestimate what even $50 a month can do over time. Sure it might not be down payment money but it could be enough to build a safety net so you can try a new job or move somewhere else with a bit more behind you.

There’s gonna be a rash of people committing crimes in their 70s and 80s just to have a place to live and three meals a day.

They’ll just have to reduce their excess spending, get a job and pull themselves up by their bootstraps! /s

I will be so happy eating cat food years from now knowing that I was more prepared than the average person.

Most Americans are just shitty at saving. Again, MOST, after expenses are accounted for still don’t save. Skill issue.

It’s relevant context to know that while about 67% of people self-report that they are living “paycheck to paycheck” (meaning they are not actively saving any money), only 30% self-report that they are actually spending more than 90% of their income on necessities.

Point being that the majority of people who aren’t actively saving, are choosing not to, spending all of their extra income instead of saving at least some of it.

As bad as conditions are overall, a significant chunk of people are making it needlessly worse for themselves, and things are not quite as dire as they’re made to seem by sensationalist media that’s quick to report that 67% figure, but never focuses on the 30% one that’s a much better indicator of the percentage of people who are actually having trouble making ends meet.

Did you just make the Avocado Toast argument?

No. Also I specifically used the ‘90% of their income’ figure and not the 95% one shortly mentioned thereafter, because I think it’s fair that even those who are struggling the most ought to be able to have some ‘fun’ with their money.

But most people do earn enough to pay for their necessities, have fun, and save. And many people don’t save for later, even though they easily can, in the name of putting more on the ‘fun’ pile.

While I think, technically, strictly correct, the big question wild be how much they could realistically “save”, and in such a hypothetical, would it really be significantly more encouraging results.

Our, realistically speaking we are generally already looking at that reality, with people putting aside a relative pittance but still feeling that they live paycheck to paycheck, largely ignoring anything that goes toward retirement.

I get it, I’ve had relatives buy stupid expensive pickups or muscle cars with obscene payment plans while barely keeping their heads above water, but even the more careful ones barely scrape by.

In my group of friends I describe what I feel related to this as, obsession with youth/fear of aging, and consumerism/tourism rebranded as spirituality/wellness/experiences

Yea, just what people want to do. Spend basically on only necessities for years/decades just so they may have an opportunity to retire. Sounds like a great plan.

That’s a straw man, so I’m not going to bother responding beyond pointing out the fallacy. Consider engaging with what I actually said.

I’m pretty sure I did. Where do you think the money for retirement comes from? Whatever they are spending on non-necessities. Sure, some people can do that without completely forgoing luxuries, but we’re talking about the low end of income here. For any meaningful retirement, and that’s a maybe, it really is forgoing any nicities for a long time.

It would have taken a lot longer for me to build the capital for a down payment if I wasn’t frugal. It helped me save and invest a little extra each month.