Summary

Trump announced that 25% tariffs on imports from Canada and Mexico will take effect on February 1, though a decision on including oil remains pending.

He justified the move by citing undocumented migration, fentanyl trafficking, and trade deficits.

Trump also hinted at new tariffs on China.

Canada and Mexico plan retaliatory measures while seeking to address U.S. concerns.

If oil imports are taxed, it could raise costs for businesses and consumers, potentially contradicting Trump’s pledge to reduce living expenses.

If oil is excluded the truly boss move on Canada & Mexico’s part would just be to introduce a 25% export premium on those products while the tariffs are in effect.

Canada’s boss move is to remove the intellectual property laws that the US asked for and let Canadian companies and consumers thrive again.

This is a really good read. Thank you.

Keep going higher, i bet Canada imports more from US than exports.

A friend of mine works for an electric semi truck company. The vast majority of their parts are manufactured in Canada and Mexico; they’re just assembled in the US. His mom voted for Trump and really wants him to move back to Ohio so he can have space and be close to family. He wanted to go back, too, and had a transfer and promotion within the company set up before the election. Now there’s a company-wide freeze and his transfer is gone. The company’s internal financial projections are not good.

His mom refuses to recognize that she just voted for her son to stay in Seattle indefinitely, even though he wants to move back. She keeps thinking that any day now, the economy will be so booming that his company will be doing great. He can’t talk to her about it anymore.

Its Americans trying to buy food who will be hit with a 25% tarriff, not Mexico. And Mexican farmers wont see a dime of that revenue, if anything they will see a decline in revenue as people stop buying the products. It all goes to the US treasury.

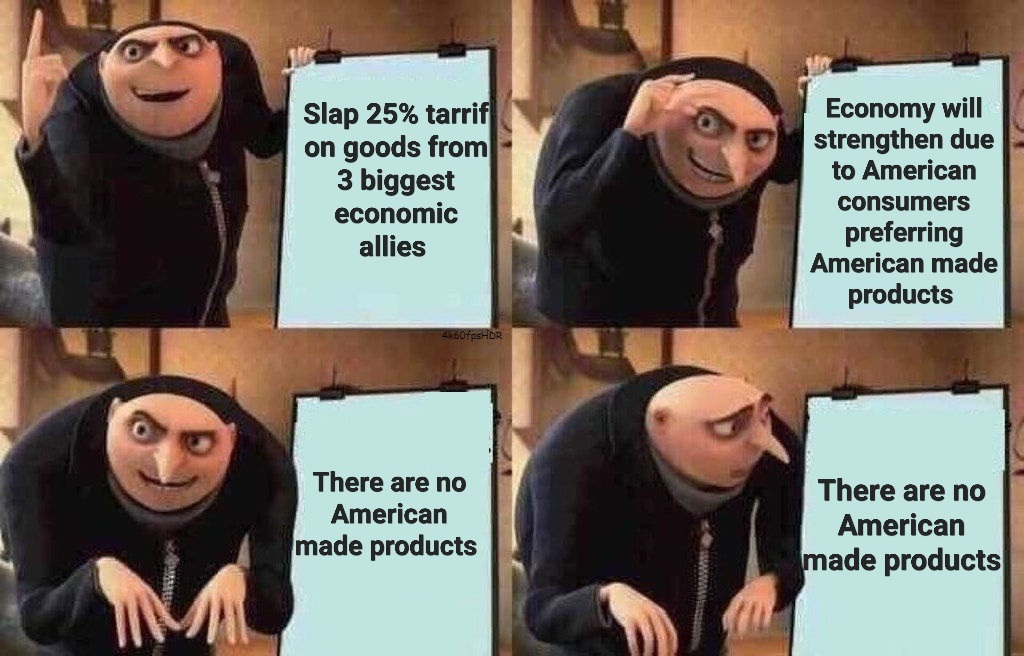

Someone make this into that Gru meme:

- Slap a 25% tarrif on goods coming from your 3 biggest economic allies

- Economy will strengthen due to American consumers preferring American made alternatives

- There are no American made alternatives

- There are no American made alternatives

Here you go

lol thank you so much

If they really wanted this to work it should be something like a steadily increasing tariff over time instead of 25% right off the bat. But I don’t think they really care about it working as intended.

i gotta be honest, i’m not entirely sure what is intended. this decision doesn’t make sense to me!

Great so now my food will cost even more?

WAY more. We import a lot of food from Mexico as is, and the immigration and ethnic clensing the Trump goverment is engaging in is already forcing farmers to watch their crops rot on the ground with no one to harvest them. So we’re following in the great tradition of Stalin and Pol Pot, we have a dumb fucking asshole with a hard on for ‘‘strong man tactics’’ demanding we change how we get food in many extreme ways immediately, you know, instead of gradual change, so we’ll all get to see what an artifical famine looks like! Do you think Trump will let other nations send us emergency rations so we won’t die? Or will he confiscate them at a dock or border and have them dumped into the ocean so he doesn’t look weak? North Korea knows.

He’ll take them for his friends and family ao they don’t have to buy food

And sell the surplus to his billionaire cabinet to be resold to the less than poor while the poors starve.

I can’t believe some people think that putting tariffs on a country means the country will just give the government 25% of everything and the merchants of that country are not just going to raise the prices to match the new expenses(or maybe even a little bit more since they have a good excuse to change prices).

I guess I can stand to eat a bit less, we can call it the economic collapse of the US diet! Just think of all the profits from the diet books! To bad they are going to cost 30% more now that my Mexican publisher is paying a tarrif to bring the books into the US. That’s OK, spending more money on the book just means that you won’t be able to afford as much food, making the diet work even better!

I can’t believe some people think that putting tariffs on a country means the country will just give the government 25% of everything and the merchants of that country are not just going to raise the prices to match the new expenses(or maybe even a little bit more since they have a good excuse to change prices)

I’m not sure anyone believes that. The point of tariffs is that merchants will have to increase prices to keep the same profit, causing people to purchase less of the product and look for cheaper alternatives (those without tariffs).

Many Americans thought the foreign country paid the tariffs, so forgive me if I disagree that my country is capable of that level of thought.

Lots of morons believe that and argues assuming that this is right.

Unfortunately, a lot of people are saying they think the county of origin pays the tariff and not the importer.

Just like the war on drugs, you’ll be able to buy black market tacos in alleys.

You aren’t already?

I love how old the orange asshole looks in the photos. Hopefully things just work out in our favor soon. It could be a permanent sleep or maybe a nice golf ball to the forehead or choked on a pretzel. I think we should probably place some …legal… Bets on how it all goes down? It shouldn’t that that long. I remember when my Grandma looked like that and we buried her a few months later.

deleted by creator

Yep, Vance is in a way more dangerous than Trump. Trump might throw wrenches in the fascists’ plans by either blurting them out proudly thinking it was his idea or by being too afraid of being unpopular (which he is obviously obsessed with) and taking back some of the changes due to public pressure. Vance on the other hand will be just a hand puppet for Putin and/or Musk.

Man have you seen him speak? I don’t know what concoction of drugs he is on or if he’s just showing his age but he’s definitely not the rager he was 5 years ago. Seems tired and much less coherant. Makes me optimistic he might be in mental decline more than I theorized previously. But if we go by the ‘asshole’ rule he’ll outlive most of the Senate just out of stubbornness and hatred. We definitely need a quick solution.

The Simpsons have not been wrong yet…

choked on a pretzel

I wonder how many people reading this remember that this actually happened to Bush the 2nd.

Those were the days. We all wished for that pretzel to have been a little bigger, a little dryer. But somehow it didn’t work out. But, it could happen again! Lightning can strike twice in the same spot. Or lightning can strike in two or more spots separately non-dependently.

Then you get to speedrun to a corporate theocracy with President Vance.

May the American people enjoy the fruits of their voting and sitting on their asses.

It wouldn’t be so bad if we didn’t get fucked by proxy of America electing an old senile fascist.

I am Canadian and I will feel Trump’s presidency for a while

I’ll enjoy seeing the US go down.

We’re reaching the “find out” stage.

This massively violates the USMCA that he signed

He doesn’t give a fuck about anything. It’s so tiring that people assume that he is rational and he cares.

Mama didn’t love him, now he’s a grumpy old man with grievances.

If you are a non-Trump voter in a red state, especially if you work for the flagship company or industry in that state, I would like to apologize on behalf of all Canadians for what our government is about to do. We don’t want to do it but it is the only way to deal with a bully.

I do ultimately think tariffs will be good for the US. I feel bad for other countries I guess, but I think the US needs to be more productive.

California, seen as a relatively “progressive” state, has a sales tax on everything, and pretty extreme sin taxes. A tariff is like a sales tax, and a sin tax on specific imports.

The way you increase productivity is via exports, not artificially increasing the cost of goods. A sin tax is when you want to stop people from doing things so you make it more expensive. If you want to increase American cement production, you subsidize production.

Adding a tarrif to Canadian cement imports increases cost for imported cement, and encourages domestic producers to increase costs to match. If the competition just got 15% more expensive, there’s no reason for me to not raise my prices 14%.

If the government comes in and says they’ll pay me $15/ton of cement I produce, that encourages me to produce more cement and lower the price to sell it. Now I’m producing more, and I need to hire another machine operator and the economy grows because the lowered cost of cement makes people more willing to do things that need cement.Tariffs are really only good for counteracting other countries subsidies. If Canada were paying manufacturers $20 a ton to produce cement, then applying a $20/ton tarrif makes the prices unbiased.

It’s why our agricultural subsidies are viewed poorly by food scarce nations: we lower the overall market cost for food, and they can’t afford to subsidize their own production, and returning equilibrium on imports would starve people, so they’re trapped in a cycle of being dependent on imported subsidized food while living next to fallow farms.

Canada and Mexico aren’t subsidizing their export industries, and a lot of what we’re trading is in things we can’t or don’t want to handle. You can’t increase American uranium production, off the top of my head.

We had a position of trade strength, which meant that we could afford to import more than we produced because our intangibles were worth more, and what we exported was worth more. Import steel and export tractors. Now we’re saying we want to stop importing steel, making it harder to export tractors, so that we can bring back low paying dangerous jobs.

If you want to see productivity grow trumps way, go get a job as a farmhand picking spinach. Because his policy is basically that we need less engineers and more farm hands.

I’m glad you started your dissertation with “the way you x is via y” because it immediately informed me that I was reading the work of an expert genius and as a smooth brain, when a genius writes, I read.

One question, wouldn’t higher prices on imported cements sort of make local cements automatically cheaper, giving them an advantage without asking them to cut corners? In a free market you will often see a “race to the bottom” on goods, whereby manufactures and producers will cut costs so low that they lose money, so long as there is some other incentives that would lead to profit. Video game consoles are a common example. The console is sold at a loss with the expectation that they will make up the difference on the consumables, games and related services.

If local competitors can produce for lower cost than competitors it may drive more people, who generally just want to save money, to local businesses, creating demand, driving growth.

Video game consoles are sold at a loss on occasion because the marginal cost of game sales is extremely high. There’s no associated product to pair with cement that would drive you to sell it at a loss.

My point was that yes, it will drive people to local businesses, because they will be cheaper. Local businesses have no reason to keep their prices the same if the competition just got more expensive however.

I’m glad you found my comment informative. I’d hate to think I was talking to someone who wanted to say their opinion and then got defensive if someone disagreed with them. It’s a sign of someone with at least a wrinkle or two that they’re open to discussing their thoughts.

For more insight from people even more knowledgeable than me:

https://www.businessinsider.com/what-are-tariffs

https://paulkrugman.substack.com/p/the-end-of-north-america

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

Well the console example demonstrates long term payout strategies. Another example is in free to play games with microtransactions. You develop a game at a cost, you give it away for free, and you hope that it’s good enough to hook people and get them to spend on “hats”. It’s a lot of money up front to make more later.

So do either of those strategies apply to the manufacturing of physical goods as are being tarifed?

Do you think that Ford is going to sell cars at a loss to make money on service contracts now that their costs are rising because some parts are fabricated in Detroit, assembled in Windsor, and then shipped back for installation in Flint? If it didn’t make sense to sell at a loss before, why would it make sense to do so now?

Do you think that there’s money to be made on getting people hooked on buying wheat perks?

We’re not talking videogame DLC, we’re talking about food, manufacturing materials, electrical power, and physical goods. The price of these things are going up, just like they went up with previous tariffs. This is a super easy case, because he did it to a lesser extent before, and it didn’t do what he’s saying it will. There’s no reason to believe that making the bad choice more vigorously will make it suddenly have a different outcome.

Google “byd china car sell at a loss” and “chicken tax”.

You will see price wars or the race to the bottom in the auto industry and you will see how tariffs on imported cars are one way we have protected domestic manufacturing.

Dude, go reread my first comment. I specifically mention tarrif as a counter to restore market balance after manipulation. These aren’t being used to counteract an anticompetitive subsidy. Raising prices to restore equilibrium and raising prices to disrupt it are very different things.

I know you want this to be something that works, but there’s a reason why reputable economists think this is just the worst idea.

Tariffs only makes thing more expensive for everyone.

Let’s say you import steel at X$/ton and it cost Y$ locally where X < Y. You add a tariff T to make the imported steel on par with local steel.

Local steel still is as expensive and any production that uses imported steel now cost more.

Nothing went down in price, only up.

Now, there is a discussion to be had about buying local, but the immediate effect is that things will cost more even if manufacturers switch to local steel because they pay more for the same quantity no matter what.

This is a simplified version of the situation, but it explains the issue.

This assumes the local product wasn’t already cost competitive. If they are close and you slap a tariff on the import that adds further incentive to pick local. Assuming local would capitalize on the added revenue via reinvestment/expansion, it would create jobs and more demand, may even make the product or services even more affordable.

Picking local versus imported has no effect whatsoever on the price of the transformed product.

Business will find the source of primary resources that is the cheapest for their needs. Best case scenario, local is what’s used already and prices won’t change.

Otherwise, the transformed product will cost more because either the businesses pay the new inflated price for imported resources or they switch to a local resources which is more expensive. Prices will raise no matter what.

Guess which one we’ll see happening?

I think the problem is that these tariffs are, for the most part, untargeted. They aren’t a “tax” on “specific imports”. They’re a blanket tax on all imports from many countries.

I thought it was targetted but again in California its all items sold are taxed and some at a higher rate.